New Delhi, September 2 (HS) : The Ministry of Finance is poised to leverage the ‘Account Aggregator’ (AA) ecosystem to open new avenues in formal credit access, especially for micro, small, and medium enterprises (MSMEs) and personal loans. This initiative is set to make a significant contribution towards India’s journey of development by 2047.

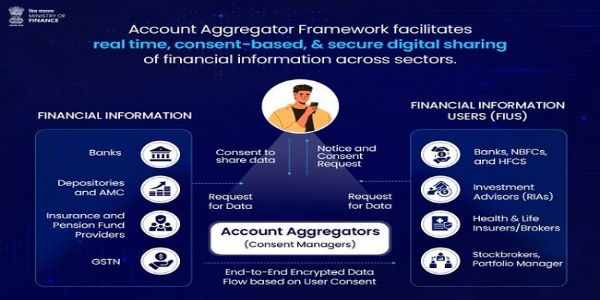

In a statement issued on Tuesday, the Ministry noted that the AA framework was officially launched on September 2, 2021, establishing a secure, consent-based system for financial data sharing. The Reserve Bank of India (RBI) had issued master directions for the AA ecosystem in 2016. Marking its fourth anniversary, the Ministry highlighted that the AA ecosystem is rapidly evolving, with accelerated adoption in banking, securities, insurance, and pension sectors, thereby strengthening India’s Digital Public Infrastructure (DPI).

According to the Ministry, to date, 112 financial institutions are actively operating as both Financial Information Providers (FIPs) and Financial Information Users (FIUs), while 56 function solely as FIPs and 410 as FIUs. The AA framework now enables over 2.2 billion financial accounts to securely share data with consent, with 112.34 million users having already linked their accounts, underscoring the growing scale and trust in this transformative initiative.

---------------

Hindusthan Samachar / Jun Sarkar