Delhi, 4 September (H.S):

The All India Trinamool Congress (TMC) has hailed the rollback of GST on insurance premiums as a “hard-won victory for the common people”. The party sharpened its attack on the BJP-led NDA government, branding it “tone-deaf, indifferent, and forced into action only under pressure.” TMC Chief Mamata Banerjee had earlier lambasted the levy on life and health insurance as “cruel” and “anti-people,” warning it would discourage families from securing financial protection.

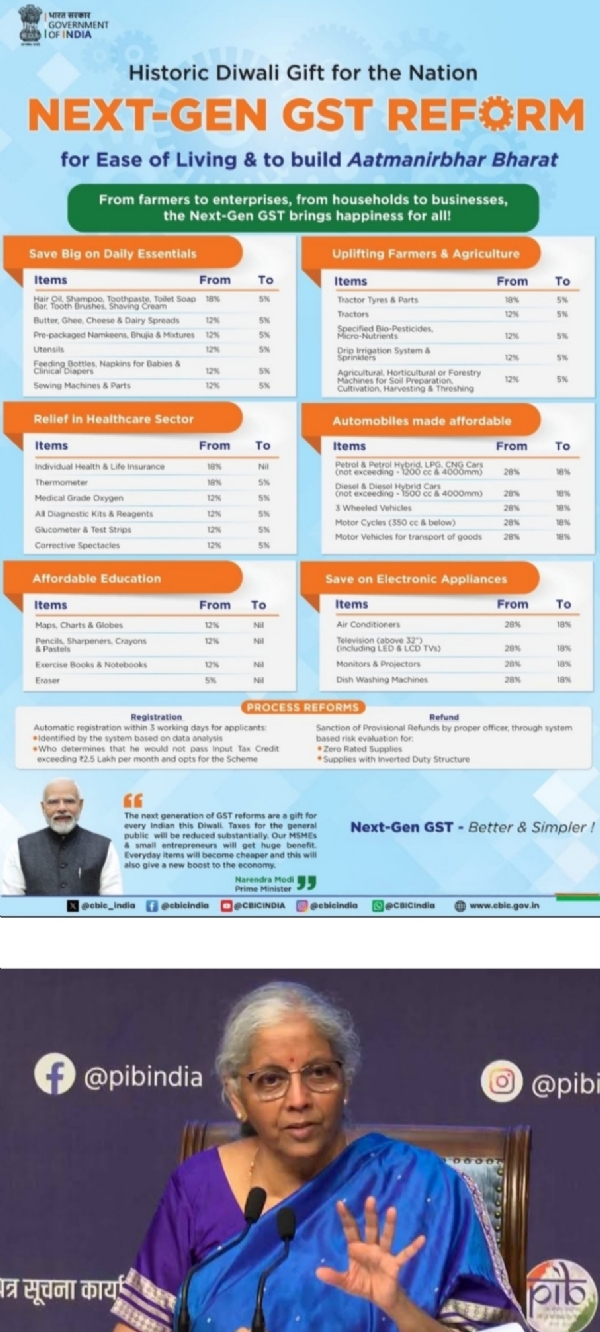

The criticism came hours after Finance Minister Nirmala Sitharaman announced landmark changes in India’s indirect tax structure at the 56th GST Council meeting. From September 22, 2025, GST will be pared down to just two slabs—5% and 18%— replacing the earlier four-tier structure. Sitharaman called it a “Next-Gen GST Reform”, designed to ease living costs, encourage compliance, and stimulate consumption.

Key Takeaways from the Reform:

-Daily essentials like paneer, roti, and paratha exempt from GST.

-Health and life insurance premiums made GST-free.

-Cement taxed at 18%, down from 28%.

-Small cars and two-wheelers under 18% (earlier 28%), while luxury cars and tobacco continue at 40%.

-Soaps, hair oil, bicycles, and affordable footwear (below ₹2,500) now at 5%.

-Agriculture and life-saving drugs remain in low/zero-tax categories.

Prime Minister Narendra Modi described the move as a “major stride toward simplifying taxation and empowering small traders.” Revenue Secretary Arvind Srivastava underlined that the streamlined framework would clear up long-standing ambiguities in classification.

Chidambaram’s Intervention: A Word of Caution

Congress veteran and former Finance Minister P. Chidambaram welcomed the relief on food, healthcare, and insurance, but issued a pointed reminder on priorities. In a sharp tweet, he argued that while reducing taxes on essentials was overdue, the true test of reform is whether tax policy favours basic consumption over luxury indulgence. He noted that maintaining a 40% GST on luxury goods and sin products is right, but warned that policymakers must resist the temptation of symbolism and stay focused on structural fairness and social equity.

The GST rationalisation and the reduction in rates on a range of goods and services are WELCOME but 8 years TOO LATE. The current design of GST and the rates prevailing until today ought not to have been introduced in the first place. We have been crying hoarse for the last 8 years against the design and rates of GST, but our pleas fell on deaf ears, he wrote.

GST Reform Recap:

From September 22, India transitions from four GST slabs to just two (5% and 18%), exempting essentials and healthcare, easing household burdens, and cutting costs for small industries—while keeping luxury and harmful goods taxed at 40%. Experts predict this reset will boost consumer confidence, simplify compliance, and strengthen MSMEs.

---------------

Hindusthan Samachar / Jun Sarkar