Kolkata, 4 September (H.S.): The Trinamool Congress (TMC) has hailed the Union government’s decision to remove the 18 percent Goods and Services Tax (GST) on health and life insurance policies as its “moral victory,” claiming that West Bengal Chief Minister Mamata Banerjee had been opposing the levy from the very beginning.

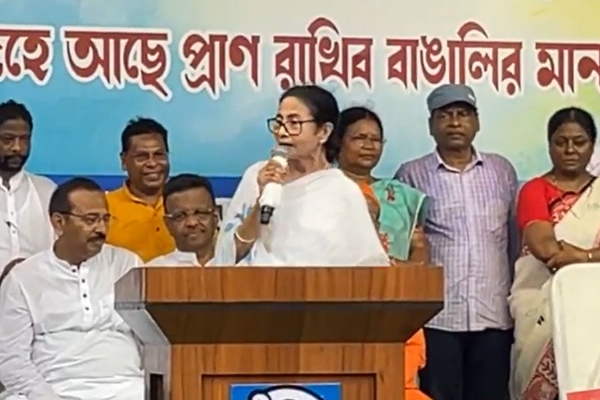

In an official statement issued on X late Wednesday night, the party said, “This is the victory of the common people, snatched from a government that only listens under pressure. From day one, Mamata Banerjee had warned the Finance Minister that taxing insurance premiums was inhuman and anti-people. Such a policy would discourage families from securing their future and leave them devastated during crises.”

The TMC also shared a copy of a letter written by Banerjee to Union Finance Minister Nirmala Sitharaman on August 2, 2024, urging a review of the tax on insurance policies.

The GST Council, in its meeting on Wednesday, decided that from September 22, individual health and life insurance policies would be completely exempted from the 18 percent GST. The move is expected to bring major relief to households and the healthcare sector.

Following the announcement, the TMC accused the BJP-led government of bowing under pressure. “The Modi government has finally relented. This rollback proves that the BJP only acts when cornered. We will continue to fight against every anti-people decision, both inside Parliament and on the streets,” the party said.

The GST Council also approved wider structural reforms, scrapping the existing 12 percent and 28 percent slabs, and retaining only the 5 percent and 18 percent rates from September 22.

Additionally, personal care items such as hair oil, shampoo, toothpaste, and dental floss will now attract 5 percent GST instead of 18 percent, while taxes on cigars, cigarettes, and other tobacco products have been increased from 28 percent to 40 percent.

Hindusthan Samachar / Satya Prakash Singh