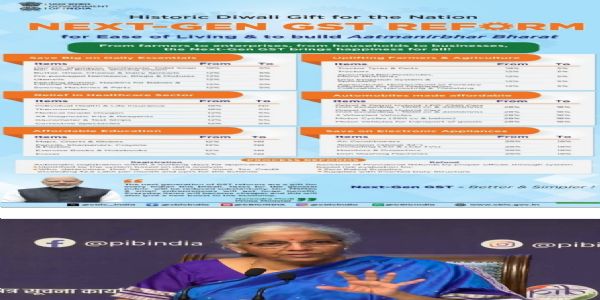

Delhi, 3 September (H.S.): The Goods and Services Tax (GST) Council began its 56th meeting on Friday under the chairmanship of Finance Minister Nirmala Sitharaman. The two-day marathon session, which concludes on September 4, is focused on revising tax rates to make everyday essentials and consumer goods more affordable. The final decisions are expected to be announced once the meeting ends.

Punjab Minister Harpal Singh Cheema revealed that the Council has decided to restructure the GST slabs. The new system will retain two major slabs — 5% and 18% — along with a special slab, while one existing slab has been removed. Bihar Deputy Chief Minister Samrat Chaudhary added that these new rates will come into effect from September 22.

One of the major reforms being considered is in the health insurance sector. The GST Council is reviewing premiums and may reduce the tax to 5%, bringing relief to policyholders. However, insurance companies are expected to face short-term pressure on profits due to the slower adjustment of existing policies.

The Council also discussed changes in the footwear and apparel sector. The threshold for products under the 5% slab may be raised to ₹2,500 from ₹1,000, though an official announcement is yet to be made. At the same time, daily-use unpackaged food items are expected to remain under the nil-tax category, ensuring no additional burden on households.

Essential food and beverage items are set to become cheaper. Products such as butter, ghee, dry fruits, condensed milk, sausages, jams, coconut water, namkeen, juices, pastries, biscuits, and cereals could see their GST rates fall from 18% to 5%. Similarly, everyday personal care items like shampoo, toothpaste, soap, talcum powder, toothbrushes, and hair oil are also likely to move from 18% to 5%.

Vehicles and electronics are another focus area. The Council is considering reducing GST from 28% to 18% on small petrol, diesel, and CNG vehicles, motorcycles up to 350cc, and consumer electronics such as air conditioners, dishwashers, and televisions. Cement is also expected to become cheaper with its GST rate possibly being cut from 28% to 18%, which would ease construction and housing costs.

However, not everything will get cheaper. Luxury apparel and footwear priced above ₹2,500 could become costlier, as the GST rate is likely to rise from 12% to 18%. Additionally, high-end vehicles above 1,200cc (petrol) and 1,500cc (diesel), large motorcycles, yachts, aircraft, racing cars, and smoking pipes may attract a steep 40% GST. Tobacco and other sin goods will also continue to remain in the 40% bracket.

Overall, the GST Council’s reforms aim to strike a balance between easing the financial burden on households by lowering taxes on daily essentials, while keeping luxury and sin goods under higher tax rates. The final announcements by Finance Minister Nirmala Sitharaman are expected once the Council meeting concludes on September 4.

---------------

Hindusthan Samachar / Jun Sarkar