New Delhi, 25 December (H.S.): In one of the most significant fiscal policy reforms in decades, the Government of India undertook a comprehensive modernization of its taxation structure in 2025, introducing sweeping changes to both direct and indirect taxes to reinforce transparency, efficiency, and predictability.

The reforms, anchored in the new Income Tax Act, 2025, were complemented by a major rationalization of Goods and Services Tax (GST) rates, higher income tax exemptions, and a commitment to simplify customs duties in the upcoming Union Budget.

The newly enacted Income Tax Act, 2025—which will come into effect from April 1, 2026, marking the start of the financial year 2025–26—has officially replaced the more than six-decade-old Income Tax Act of 1961, signaling a historic restructuring of India’s direct taxation regime.

Key Legislative Reforms

The simplified Income Tax Act, 2025, passed by Parliament following extensive deliberations, eliminates redundant provisions, streamlines tax procedures, modernizes legal language, and introduces the concept of a “Tax Year” to replace the traditional notions of “Previous Financial Year” and “Assessment Year.”

Additionally, two supplementary legislations were introduced—to levy additional excise duty on cigarettes and to impose an incremental cess on pan masala and related tobacco products—which will come into force on dates notified by the central government.

Government officials described the reform package as a transformative step aimed at stimulating domestic demand, rationalizing compliance, and strengthening India’s position in the face of a challenging global economic environment. The overall goal, they said, is to encourage consumption, simplify taxpayer experience, and ensure equitable growth through a transparent and digitally enabled tax framework.

Simplicity and Digital Integration

The Income Tax Act, 2025 has been drafted with three core objectives: simplification, digital integration, and taxpayer-centric design. Archaic language has been replaced with contemporary, clear wording, and scattered provisions have been consolidated into cohesive sections. Complexities that previously burdened small taxpayers and professionals have been addressed through digitally enabled compliance and faceless assessment systems, minimizing human intervention and reducing potential corruption.

For instance, the provisions relating to Tax Deducted at Source (TDS)—previously spread across multiple sections—have now been unified under Section 393, ensuring clarity, accessibility, and ease of interpretation. This merges procedural and legal steps into a more uniform mechanism that benefits taxpayers, tax practitioners, and administrative officers alike.

A Taxpayer-Focused Framework

The restructured legislation emphasizes a citizen-first approach. By simplifying return filing procedures, cutting litigation, and expanding transparency in assessments, the new framework seeks to foster voluntary compliance among taxpayers. Data-driven verification tools and centralized faceless scrutiny will further strengthen confidence in the tax system.

The government has also authorized the creation of new administrative plans under Section 532 to enhance efficiency and accountability in the tax ecosystem. These plans enable the central government to:

Eliminate direct interface between taxpayers and officials wherever technologically feasible.Optimize resource use through economic rationalization and digital specialization.This visionary clause represents a shift toward a data-centric model of governance in taxation—consistent with India’s broader digital transformation agenda.

The “Tax Year” Concept

Among the most noteworthy structural changes is the introduction of the term “Tax Year”, which replaces the long-standing “Financial Year” and “Assessment Year.” Defined as a twelve-month period beginning on April 1, the Tax Year simplifies understanding of fiscal timelines, making it easier for both individuals and corporations to identify the specific period applicable for tax filing.This reform aims to reduce confusion, improve taxpayer awareness, and ensure clear alignment between income recognition and tax computation periods.

According to senior finance officials, this single-unified concept will make India’s fiscal dictionary far more intuitive and comparable with international practices.

Redefining the Digital Economy

In recognition of the country’s rapidly evolving digital ecosystem, the Income Tax Act, 2025 also provides a wider definition of Virtual Digital Assets (VDAs)—explicitly covering cryptocurrencies, tokenized assets, and all forms of cryptographically secured virtual holdings.

For the first time, the Act defines “Virtual Digital Space” as any environment or platform—whether email servers, cloud storage, blockchain networks, or social media and investment platforms—where digital value is created, stored, traded, or transferred. This inclusion not only broadens the taxation net but also enhances India’s ability to regulate and tax digital economic activities consistent with global norms.

Global Benchmarking and Modern Tax Governance

The government underscored that the Income Tax Act, 2025, follows global best practices and reflects the aspirations of a modern economy. It focuses on clarity, accessibility, and predictability, ensuring that both domestic and international investors can operate in a rules-based, transparent environment.

Its design does not merely revise tax rates, but aims to reshape the tax experience—making it simpler, predictable, and digital-first. Tabs, tables, and structured schedules have been integrated for better readability, enabling users to navigate complex calculations without additional guidance.

The government’s consistent focus since 2014 on “Minimum Government, Maximum Governance” continues through this reform. Legal experts say that the streamlined layout, reduced number of chapters, and clarity-driven structure mark a departure from legacy-style compliance systems and pave the way for a taxpayer-friendly ecosystem.

From Income Tax Act 1961 to Income Tax Act 2025

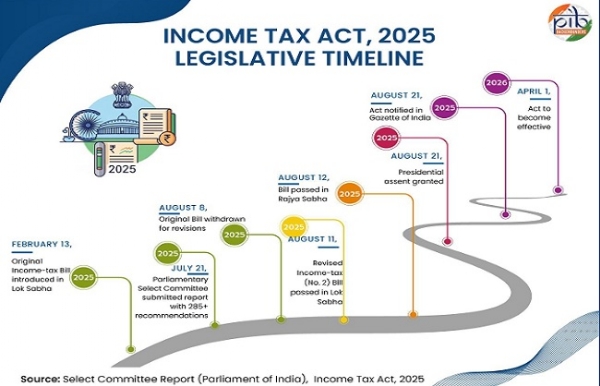

The transition did not occur overnight. The Income Tax Act, 1961, had governed India’s fiscal policy for over sixty years, accumulating layer upon layer of amendments. In 2024, the government initiated a full-scale review of the statute, leading to the draft Income Tax Bill, 2025, which was initially referred to a Parliamentary Standing Committee for detailed scrutiny.

Extensive consultations with stakeholders—including tax professionals, economists, and industry associations—resulted in substantive revisions. The government subsequently introduced the Income Tax (No. 2) Bill, 2025, incorporating most committee recommendations, improving language drafting, and enhancing legal clarity.

Both Houses of Parliament passed the updated version during the Monsoon Session of 2025, officially establishing the new Act as the cornerstone of India’s restructured tax framework.

Customs Simplification on Horizon

Finance Minister Nirmala Sitharaman, in recent remarks, identified simplifying customs regulation and rationalizing tariff rates as the next major frontier of India’s ongoing tax reforms.She said transparency mechanisms like those applied to income tax—such as faceless assessment—would also be integrated into customs administration.

The government, she added, is committed to ensuring rational tariff structures and minimizing interpretative ambiguities in import policies.

Historic GST Reforms: Two-Tier System Introduced

Alongside direct tax reforms, the year 2025 also saw landmark changes in India’s Goods and Services Tax (GST) regime. Beginning September 22, GST rates on about 375 items were reduced to alleviate tax burdens on everyday goods and address long-standing concerns around inverted duty structures.The previous four-tier structure (5%, 12%, 18%, and 28%) was streamlined into two principal slabs—5% and 18%— in a move described by economists as one of the most pragmatic shifts since the GST’s inception in 2017.The aim was to make the indirect tax system simpler and more predictable, reduce litigation, and lower compliance costs for small businesses.

Although the reduction exerted short-term pressure on revenue, it enhanced consumer sentiment and reduced tax distortions across sectors.GST Collection Trends and Fiscal ImpactFollowing the structural change, India’s GST revenue reached a record ₹2.37 lakh crore in April 2025, with the average monthly collection during FY 2025–26 settling at around ₹1.9 lakh crore.

However, as lower rates came into full effect, receipts experienced moderation.By November 2025, monthly GST collections had dipped to approximately ₹1.70 lakh crore, marking a modest 0.7% year-on-year growth. This was the first full month reflecting the impact of the September rate cuts.

Officials, however, maintained that these changes are revenue-neutral in the long run, as simplified slabs would boost compliance and broaden the tax base.

Boost to Disposable Incomes and Consumption

On the direct tax front, the government raised income tax exemption thresholds, significantly benefiting middle-income taxpayers and urban professionals. This put more disposable income in consumers’ hands, stimulating domestic consumption during a period of global growth slowdown.

Analysts hailed the move as both consumption-oriented and compliance-friendly, aligning with the government’s dual objective of reviving demand while encouraging voluntary submission of returns.

A Modern, Efficient, and Fair Tax Ecosystem

At the macro level, the new Income Tax Act reinstates the principles of equity, neutrality, and administrative efficiency. It not only simplifies the law but integrates digital compliance interfaces, reducing the human element in tax enforcement.

Features like faceless assessment, centralized e-adjudication, and integrated analytics make it among the most advanced digital tax administration systems in the world. The law also aligns India’s tax definitions and enforcement mechanisms with contemporary realities such as cross-border digital trade, virtual asset ownership, and blockchain-based income streams.

Transparent and Accountable Governance

According to the Ministry of Finance, the core philosophy behind the 2025 tax reform package is to transform taxation from a process of obligation into a system of trust while ensuring fiscal discipline and institutional accountability.

The ministry categorized its objectives under the following pillars:

Simplification: Replace outdated and redundant provisions with a clean, accessible legal framework.

Digitization: Eliminate physical interface and enhance transparency through real-time digital tools.

Taxpayer-Centric Administration: Improve ease of filing, minimize disputes, and ensure fairness.

Global Alignment: Reflect contemporary economic trends such as digital asset taxation and global income disclosure.

Toward a Predictable and Integrated System

Experts believe that the Income Tax Act, 2025, and accompanying reforms mark India’s most ambitious step toward achieving fiscal simplicity. The streamlined GST, combined with rationalized customs, is expected to promote cross-sector stability, attract foreign investment, and support India’s transition to a $7 trillion economy by the early 2030s.

By minimizing interpretive complexity and increasing certainty, these measures project India as a pro-growth, compliance-friendly jurisdiction—a critical priority amid shifting global supply chains.

Conclusion: Blueprint for a Modern Fiscal Future

The Income Tax Act, 2025, represents more than mere legislative restructuring—it embodies the government’s vision of a digitally empowered, transparent, and equitable tax system that mirrors India’s transformation into a modern, data-driven economy.

By aligning domestic taxation with international best practices, simplifying compliance, and adopting a citizen-oriented approach, the Act sets the foundation for a new era of trust-based governance. It reinforces India’s commitment to promoting ease of doing business, voluntary tax culture, and inclusive growth.

In line with Prime Minister Narendra Modi’s vision of “Vikasit Bharat” (Developed India), these reforms ensure that India’s tax system evolves into one that is simpler, fairer, globally competitive, and future-ready—a fiscal architecture designed to serve both growth and governance in equal measure.

---------------

Hindusthan Samachar / Jun Sarkar