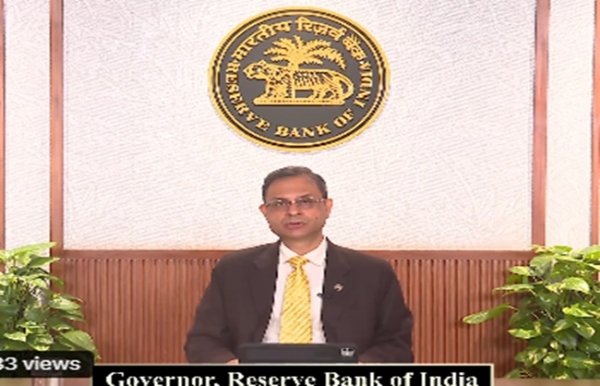

New Delhi, October 1 (HS): The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) on Wednesday decided to keep the key policy repo rate unchanged at 5.5 percent, while revising upwards its GDP growth projection for the financial year 2025-26 to 6.8 percent. RBI Governor Sanjay Malhotra announced the decision after the conclusion of the MPC’s three-day bi-monthly review meeting.

“The MPC has unanimously decided to maintain the repo rate at 5.5 percent,” Malhotra said, adding that inflation is now expected to ease further in FY 2025-26, with the Consumer Price Index (CPI)-based inflation projected at 2.6 percent compared to the earlier estimate of 3.1 percent.

Presenting the bi-monthly monetary policy review, the Governor highlighted that despite global headwinds, India’s economy showed resilience in the first quarter, supported by a favorable monsoon, lower inflation, and monetary easing measures. He underlined that these factors provide a strong foundation for growth momentum.

According to the RBI’s revised forecast, the real Gross Domestic Product (GDP) growth for FY 2025-26 is set at 6.8 percent, up from the earlier 6.5 percent estimate. Malhotra also noted that rationalization of Goods and Services Tax (GST) rates would help ease inflation while stimulating consumption and economic expansion.

The central bank maintained a neutral policy stance, indicating that it will retain flexibility for adjustments in line with evolving economic conditions.This marks the second consecutive policy review where the repo rate has been left unchanged at 5.5 percent. Earlier this year, from February to June, the RBI had implemented a series of rate cuts totaling 1 percent, including a 50 basis points cut in June and two earlier reductions of 25 basis points each in February and April.

However, no rate change was announced in the August review.

Hindusthan Samachar / Jun Sarkar